How to Become an Independent Auto Damage Appraiser

From $0 to $67,979 Per Year — No Degree Required

A beginner-friendly roadmap to training, licensing, tools, workflow, and landing paying work as an independent appraiser.

Introduction

Congratulations on taking the first step toward a fulfilling career as an Independent Auto Damage Appraiser (IA). This ebook is your practical roadmap from zero to professional, targeting an achievable annual income of $67,979+ based on typical entry-to-mid-level independent appraisers handling a steady stream of claims.

In this role you’ll inspect damaged vehicles, estimate repair costs, and create reports that help insurers, shops, and clients settle claims fairly. Demand is evergreen and independents enjoy flexibility, remote options, and entrepreneurial control. We’ll cover skills, training, licensing, tools, daily workflow, getting your first jobs, and scaling.

Most readers can break in within 3–6 months. Yes, there will be rain, rush hours, and negotiations—but the autonomy and income are worth it.

Chapter 1: Understanding the Role of an Independent Auto Damage Appraiser

What Does an IA Do?

Evaluate vehicle damage objectively, document photos and notes, and produce estimates with industry software. You’ll decide on parts, labor hours, and when a vehicle is a total loss (often 70–80% of ACV, depending on state/insurer policy). As an independent contractor, you may handle 5–15 claims/day billing $200–$500 each, depending on complexity and market.

A Day in the Life

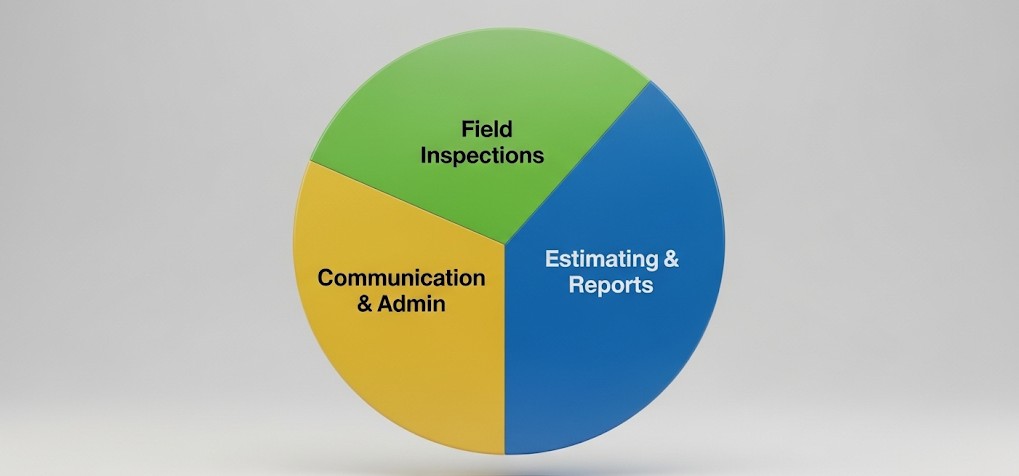

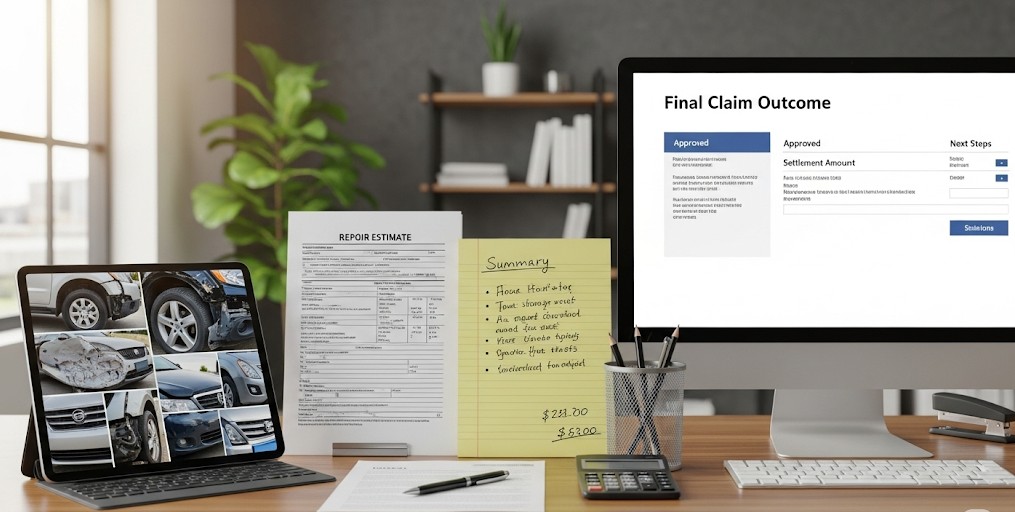

Morning: review new assignments; route your day. Inspections: 30–60 minutes per vehicle at shops, lots, or driveways. Afternoon: build estimates, write reports, negotiate supplements, submit deliverables.

Why Choose This Career?

- Low barriers: No degree required; skills are trainable in weeks.

- High demand: Auto claims are constant nationwide.

- Scalable income: Volume + efficiency = growth.

- Lifestyle: Flexible scheduling and independence.

- Variety: From fender-benders to exotics and EVs.

Types of Appraisals

- Collision — post-crash damage including hidden suspension/structural issues.

- Comprehensive — hail, flood, theft/vandalism; may use paint-thickness gauges.

- Total Loss — repair cost vs. market value (NADA, etc.).

- Specialty — antiques, RVs, EVs (battery/ADAS considerations).

Challenges & Solutions

Weather, tight deadlines, and tough negotiations. Mitigate with proper PPE, route-planning, time-boxing, and consistent ethics (e.g., USPAP-style impartiality).

Chapter 2: Required Skills and How to Acquire Them Quickly

Most core skills can be built in 4–8 weeks with disciplined daily practice. Focus on technical knowledge, analysis, communication, software, organization, and safe fieldwork.

| Skill Category | Specific Skills | Why It Matters | How to Learn Quickly |

|---|---|---|---|

| Technical Knowledge | Identify parts; assess structural vs. cosmetic damage; repair methods (welding, painting). | Prevents inaccurate estimates; ensures safety compliance. | YouTube channels (ChrisFix, EricTheCarGuy), Haynes manuals, junkyard practice (2–4 weeks). |

| Analytical | Labor hour math; detail-oriented inspections; value assessments. | Accurate reports build credibility; reduce supplements. | Practice estimating from photos; Excel basics; math refreshers (1–2 weeks). |

| Communication | Clear report writing; negotiating supplements; explaining findings. | Reduces disputes; speeds approval. | Summarize findings in plain English; role-play; Toastmasters (1 week). |

| Digital Proficiency | CCC One, Audatex, Mitchell; photo handling; virtual inspection tools. | Meets industry standards; improves throughput. | Trial tutorials, vendor webinars (2–3 weeks). |

| Organizational | Scheduling; prioritizing; documentation management. | Handle 10+ daily tasks without burnout. | Calendar blocks; Trello/Notion boards; batch work. |

| Physical/Field | Safe lifting; under-vehicle checks; calipers/paint gauge use. | Thorough inspections; personal safety. | OSHA safety videos; shadow a tech; PPE habits (1–2 weeks). |

6-Week Learning Plan

- Weeks 1–2: Auto anatomy + vocab; daily videos + flashcards.

- Weeks 3–4: Hands-on practice; inspect 5–10 vehicles.

- Weeks 5–6: Estimating software; write 10 sample estimates.

- Ongoing: Communication drills; networking; feedback loops.

Chapter 3: Education and Training Options

No degree required. Target 40–100 hours of structured training to accelerate entry.

| Program | Format | Pros | Cons | Typical Duration |

|---|---|---|---|---|

| IA Path | Online + mentorship | Beginner-friendly, job leads, software exposure | Tuition cost | 30–60 days |

| AdjusterPro | Online | State-specific licensing prep, affordable | Exam-focused, less hands-on | Self-paced |

| BOCAA (IACP) | Online (40 hr) | Ethics & standards | Basic depth | ~1 week |

| I-CAR | Online/In-person | Industry-recognized repair knowledge | Module costs | Modular |

| AVDI / Vendor Courses | Online | Estimating focus, flexible | No mentorship | 1–3 weeks |

Chapter 4: Certifications and Licensing

Certifications

- IACP (via BOCAA): 40 hours covering standards/ethics; good entry signal.

- ASCA: Advanced credibility; often requires experience or equivalent.

- NAAA: Broad automotive appraisal association, useful networking.

- IA Path Cert: Entry-level credential with job leads.

State Licensing (sample — verify current rules)

| State | License Required? | Key Requirements | Exam | Notes & Renewal |

|---|---|---|---|---|

| New York | Yes | PSI exam; 6 mo experience or training; background check | Yes | Fees ~$100+; renew ~2 yrs with CE (~24 hrs) |

| Massachusetts | Yes | ~60 hrs course + 3-month apprenticeship | Yes | Annual renewal; CE ~10 hrs |

| South Carolina | Yes | Pearson VUE exam; fingerprints | Yes | Renew ~2 yrs; CE required |

| Delaware | Yes | 18+; clean record | Yes | Biennial renewal |

| Pennsylvania | Yes | Training equivalent to 6 mo experience | Yes | Renew ~2 yrs; CE ~24 hrs |

| Nevada | Yes | DOI application; possible exam | Varies | Annual renewal |

| California | No | Adjuster license optional | N/A | High demand; certs help |

| Texas | No | Certs preferred by networks | N/A | Focus on independent roles |

| Florida | No | Virtual roles common | N/A | Certs + experience recommended |

Chapter 5: Gaining Experience with No Prior Background

Zero experience is normal. Use these avenues to build a credible track record in 3–12 months.

- Apprenticeships: Mandatory in MA; optional elsewhere; ask shops and local DOIs.

- Trainee roles: Insurers (GEICO, Progressive) hire estimators with training.

- Mentorship: IA Path pairs beginners with pros.

- Related roles: Detailer, claims clerk, body shop assistant.

- Portfolio: Do 20–30 practice appraisals; store in Google Drive.

Chapter 6: Setting Up Your Business

Legal & Financial

- LLC (protects personal assets; $100–$300 typical filing).

- EIN & Banking (separate business account).

- Insurance — E&O (~$500/yr) and general liability.

- Taxes — 1099; track mileage and tools; pay quarterlies.

Office & Startup Budget

Home office + laptop; reliable vehicle; starter kit typically $2,000–$6,000 including marketing.

Marketing Basics

- Website: Simple services page + samples.

- Networking: LinkedIn groups, local auto events.

- Lead gen: Small Google Ads budget; join rosters early.

Chapter 7: Finding and Securing Jobs

There’s consistent demand for independents. Focus on rosters, entry-friendly appraisal firms, and trainee roles at insurers.

Strategies

- Join independent networks/rosters early.

- Search boards (Indeed, ZipRecruiter, Glassdoor) and apply weekly.

- Consider Upwork for private gigs and virtual estimating roles.

- Keep a tidy portfolio and 2–3 reference letters.

Companies Open to New IAs

- IA Net — national coverage; flexible contractor roles; fast pace.

- SCA Appraisal Company — strong network; training support; roster entry.

- The Doan Group — New England & beyond; analytical focus; trainable roles.

- Others: Complete Claims Service, National Appraisal Service, carrier trainee roles (e.g., State Farm).

Chapter 8: Tools and Software Essentials

Estimating Software

- CCC One — wide adoption; AI assist; robust parts database.

- Audatex — friendly UI; mobile options.

- Mitchell UltraMate — deep features for complex repairs.

- Snapsheet — virtual/cloud claims handling.

Expect subscriptions in the $100–$300/mo range—trial first.

Physical Tools

- Digital camera or phone with good optics

- Tape measure, flashlight, mirror, calipers

- Paint thickness gauge ($50–$100)

- Safety gear: gloves, glasses, vest

Chapter 9: Day-to-Day Operations & Best Practices

Typical Workflow

- Intake assignment (portal or email).

- Schedule and route inspections (batch nearby claims).

- Capture 20+ photos and structured notes (use a template).

- Estimate with local labor rates; justify choices.

- Submit PDF report; track status; handle supplements.

Best Practices

- Use voice-to-text for notes; tag by panel.

- Always crawl low (mirrors/flashlight) for undercarriage checks.

- PPE always; avoid solo night inspections.

- Batch similar tasks to maintain focus.

- Set SLAs (e.g., same-day estimate submission).

Chapter 10: Advancing Your Career & Increasing Earnings

- Specialize: ADAS/EVs, commercial vehicles, heavy equipment.

- Expand services: Diminished value, total loss desk reviews.

- Scale: Subcontract routine inspections; keep QA and negotiations.

- Market: SEO basics; ask happy clients for Google reviews.

Targeting $67,979+: maintain a pipeline of 200–300 claims/year. Improve cycle time with templates and keyboard shortcuts. The top 10% surpass $100k by pairing specialization with volume and subcontractors.

Resources

- Associations: NAAA; BOCAA/IACP; regional appraiser groups.

- Books: Collision Repair Basics; estimating vendor manuals.

- Communities: AdjusterTV; Reddit r/Insurance; LinkedIn groups.

- CE & Training: I-CAR modules; vendor webinars; safety refreshers.

Final word: Start now. Build one habit, one estimate, one client at a time. Momentum is your best mentor.

FAQ: Independent Auto Damage Appraisers

How long does it take to become an independent auto damage appraiser?

Most beginners can be field-ready within 3–6 months with focused training, estimating software practice, and a basic portfolio.

Do I need a college degree?

No. A high school diploma or GED is sufficient. Certifications and state licensing (where required) matter more.

Which estimating software should I learn first?

Start with CCC One or Audatex; Mitchell UltraMate is also widely used by carriers and shops.

How much can a new IA earn?

New independents commonly target $50k–$80k in year 1–2 by handling 200–300 claims per year.

Is state licensing required everywhere?

No. Some states require an appraiser license and exam; others don’t. Verify with your state DOI before applying.

What physical tools do I need to start?

Camera/phone with good optics, tape measure, flashlight, mirror, paint thickness gauge, and basic PPE (gloves, glasses, vest).